public bank personal loan repayment table

AKPK Financial Management and Resilience Programme URUS AKPK URUS. Enter loan interest rate in Percentage.

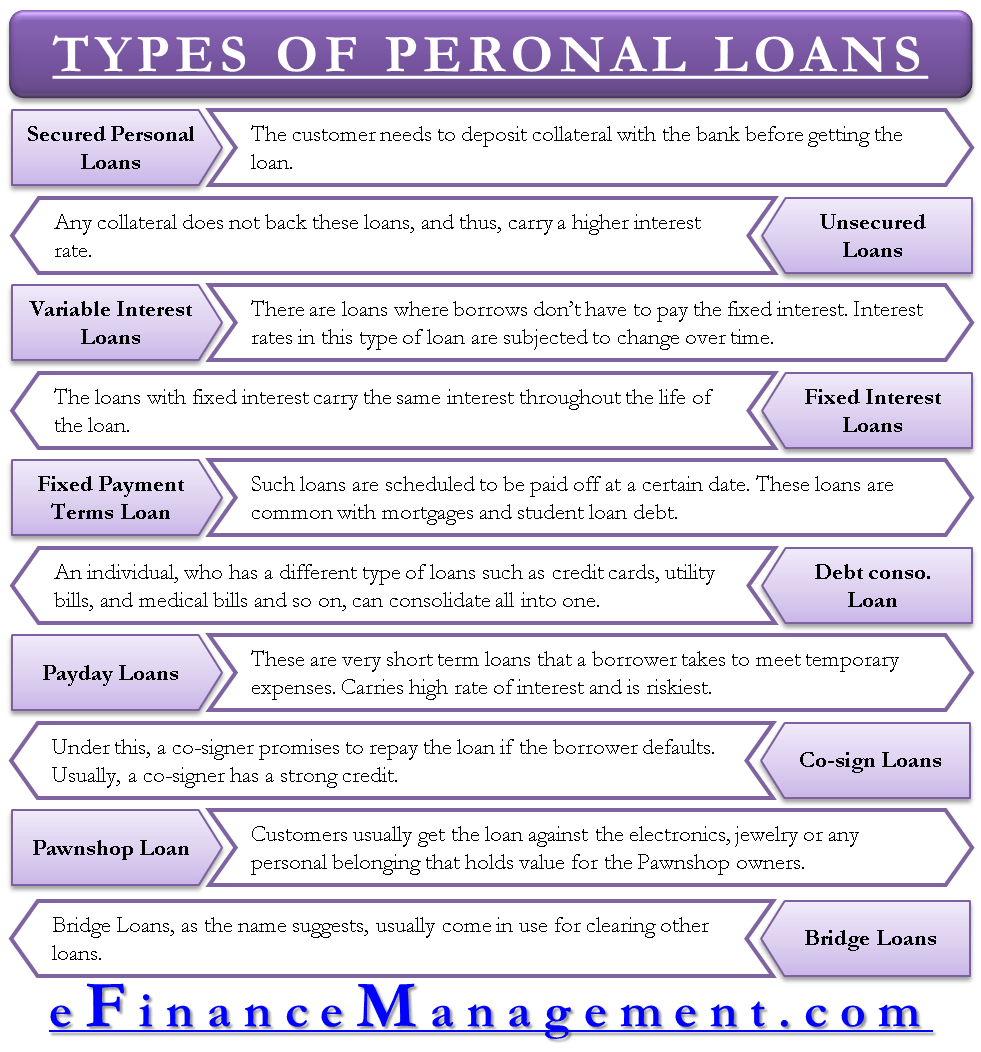

Types Of Personal Loans These Are The Options You Have

2 years 24 months.

. 50 of existing instalment. Step 2 - Our Financial consultants will assist you with your enquiries. RM 500 per request Ad-hoc Step 1 - Fax or email your NRIC Military ID or Police ID and the Personal Financing-i application form to Al Rajhi Bank Fax No.

Generate principal interest and balance loan repayment chart over loan period. If you are an existing customer you can enjoy additional discounts on the interest rate and attractive personal loan processing fees. Generate principal interest and balance loan repayment table by year.

Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Effective interest rates may vary from 1153 to 1468 per annum depending on the loan. Fees Charges Product Disclosure Sheet Illustration Payment Schedule The published rates fees and charges are effective from 1st April 2019 following the implementation of 6 SST from 1st September 2018.

RM24167 For further queries please call our Maybank Group Customer Care at 1300 88 6688 or visit our nearest Maybank Branch. Whichever higher Resume 100 existing instalment. 5000 x 2 x 8 500024 Monthly Repayment Amount.

For any enquiries please visit the nearest branch or call our Contact Centre tele-Rakyat at 1-300-80-5454. Quick cash up from a minimum quantum of RM5000 to a maximum of RM200000 Hassle-free payment option via salary deduction from employer No guarantor required Requirements. Malaysian citizens aged 20 years and not exceeding 60 years Permanent staff of at least 3 years in service at any of our approved agencies.

Annual Financing Statement Fee. Enter loan period in Months. 25 lakh icici bank personal loan can be availed online without any hassle and can be repaid within a flexible tenure ranging from 12 to 60.

Union bank of india personal loan interest rate starts at 890 pa. Pay 25 of existing monthly loanfinancing instalment. Apply Public Bank personal loans with low profit rate from 488 pa Public sectorGov GLC only RM15k minimum income loan RM5k-150k for 2-10 years.

PBB 2022 Repayment Assistance. Monthly loan interestfinancing profit rental. Enter personal loan amount in Malaysian Ringgit.

Estimate monthly personal loan repayment amount. RM5000 Repayment Tenure. Terms conditions apply.

Housing Loan Financing and Personal Loan Financing. Pay 50 of existing monthly loanfinancing instalment.

How To Calculate Your Net Worth

Bank Of Baroda Personal Loan Status Enquiry Loan Status Online Personal Loans Bank Of Baroda Baroda

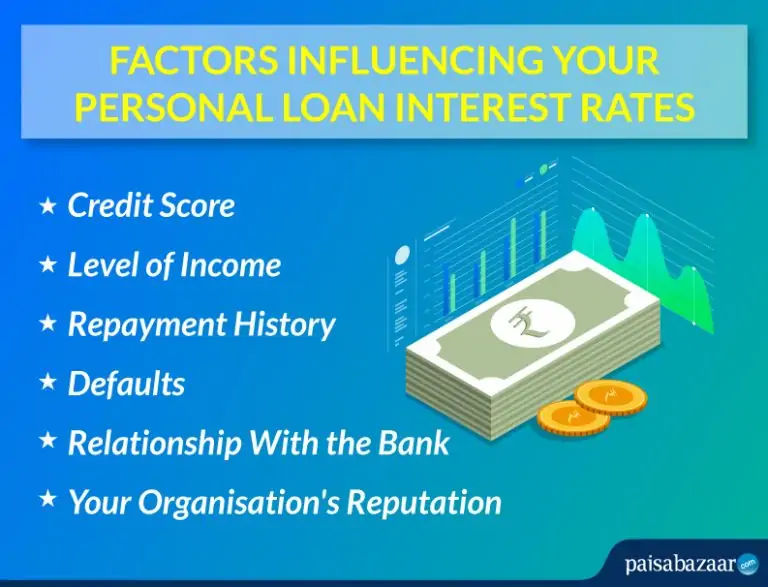

6 Factors That Can Affect Your Personal Loan Interest Rates

Where To Get Small Personal Loans Of 3 000 Or Less Student Loan Hero

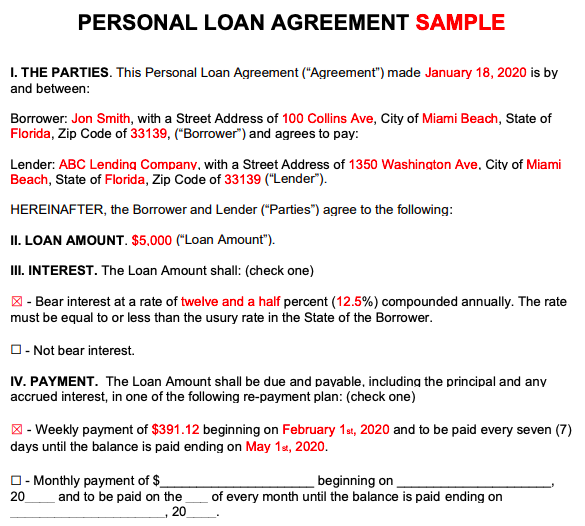

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Use Bajaj Finance Personal Loan Emi Calculator To Know Repayment In Advance Personal Loans Online Loans Personal Finance

Personal Loan V S Business Loan Which Is Better For Small Business

Want To Take A Personal Loan For Wedding Here S What You Need To Know

Bank Of Maharashtra Maha Super Housing Loan

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Free Personal Loan Agreement Template Sample Word Pdf Eforms

17 Best Personal Loans For August 2022 Credible

To Add To Our List Of Financial Services We Bring Home Loan Sbi Services With Easy Applications And Non Stringent Elig Home Improvement Loans Home Loans Loan

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

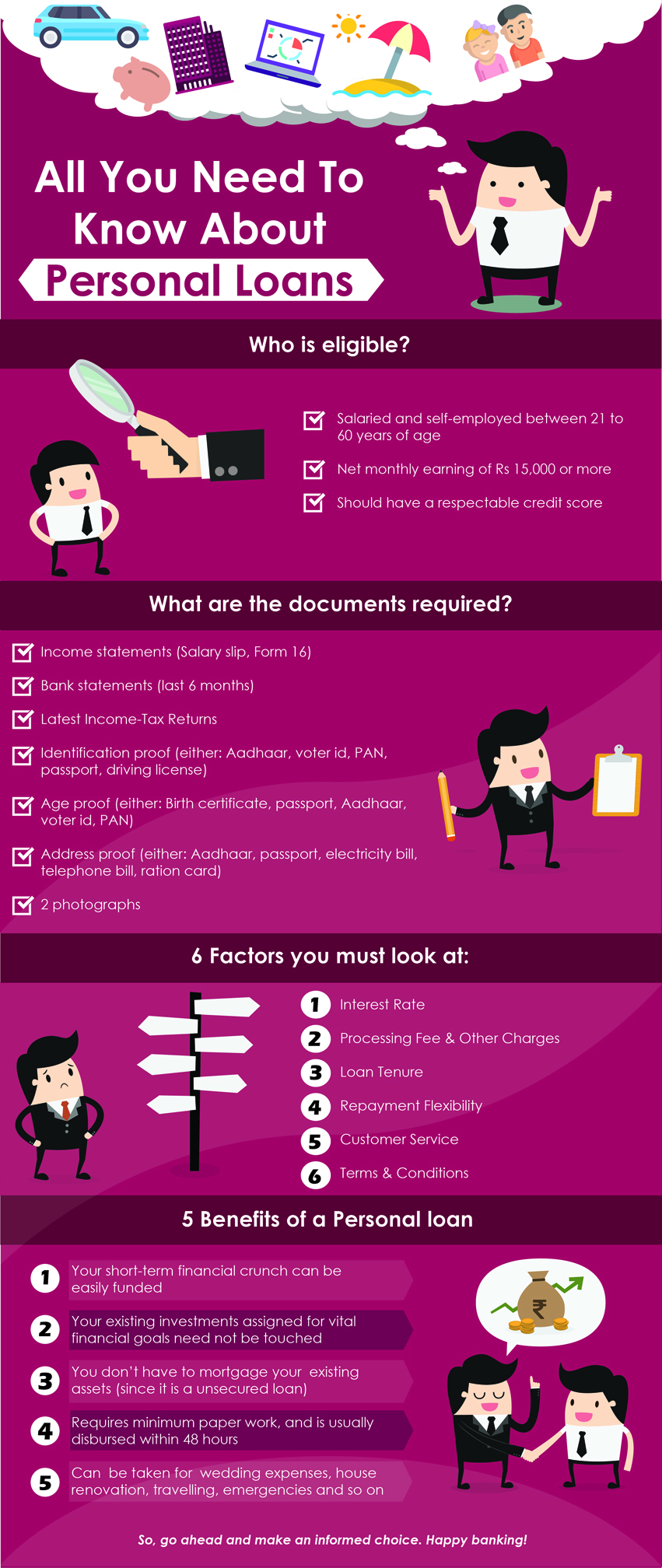

Personal Loan Agreements How To Create This Borrowing Contract

How Do I Apply For An Icici Personal Loan Personal Loans Personal Loans Online Low Interest Rate

Apply Bank Of Baroda Business Loan Cheapest Lowest Interest Rates Afinoz Business Loans Bank Of Baroda Baroda

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)